How To Avoid Impulse Buys And Stay On Budget

We’ve all been there, right? All we’re trying to do is some simple shopping, maybe online or maybe in a store. We’re gonna be good…no impulse buys…just what we came for and that’s it.

Nope! Not so fast!

Something catches our attention, maybe it’s a good deal or it just looks cool. Either way, we decide why not and toss it into the cart too.

Don’t feel bad, 90% of Americans admit to giving into the excitement that impulse buys create. And it’s hard to blame anyone, every store online or offline is structured to encourage impulse buys!

What Is Impulse Buying?

You know when you’re standing in line at the grocery store checkout and you grab that delicious 4 pack of Reese’s because…well, why not? No, wait, make that 2 packs because they’re 2/$4.00!

That right there is an impulse buy. Now, that is a very small example of what impulse buys are but they can be much larger or vary anywhere in between.

I’ll give you an example of an impulse buy that completely snuck up on me.

On my very first trip to NYC with my wife, we wanted to visit Chinatown. I hinted at this story in my article on holiday travel expenses and I still plan to share a more detailed story some day but here is the reader’s digest version.

We asked the hotel concierge for directions to Chinatown and then they asked if we’d be interested in a Hilton Vacations presentation (this was a Hilton hotel we were staying at) and we’d get a $50 gift card for attending. OK, cool…whatever, we said yes.

It was for a Hilton Grand Vacations timeshare package. And damn if they didn’t make it sound so irresistible.

They hooked us on the spot, it was like a $10,000 purchase spread out over monthly payments. (Long story short we backed out of this deal when we got home but did buy a different Hilton timeshare off eBay. I’ll definitely have to write a more detailed piece on this!)

Now, THAT was quite the impulse buy, but let’s get into more every day impulse buys, why they happen and what we can do to stop them.

What Causes Impulse Buyers?

There are many situations that can cause impulse buys, here are just a few of the more common reasons.

Perception Of Lower Prices

Who doesn’t love a good deal right? It’s only natural for you to want to save money on your purchases. If it’s something you were looking at getting anyway but then you see something like “Regular: $24.99…SALE: $17.99” wouldn’t you be much more likely to buy?

Retailers and marketers know this too. And, while legit sales do happen especially around the holidays, chances are the product is usually $17.99 anyway and they’re just trying to lure you in.

Everyone wants to think they got a good deal whether they did or didn’t.

Scarcity (and Anxiety)

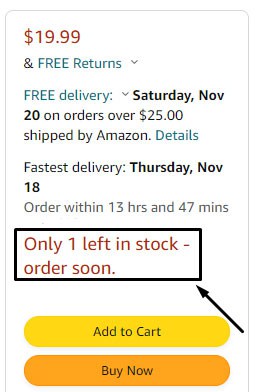

If you shop a lot on Amazon you’ve probably seen this before where it might say “Only 1 left in stock, order soon!”

And you start to think “Oh, shoot, I better hurry up before they run out of stock” especially if you’re doing some last minute Christmas shopping and the pressure is starting to mount! I know I’ve felt that anxiety start to kick in before.

Scarcity is a very real and effective marketing trick to get you to buy now. You have heard of FOMO? Fear of missing out…scarcity is just creating FOMO for you, which triggers heightened anxiety levels.

Retail Therapy

Everyone deals with stress differently and shopping can certainly be one of the ways we cope with the everyday stresses in our life.

According to the Cleveland Clinic, dopamine (the hormone that makes you feel good) is released when you start shopping.

Just the anticipation of getting something you want or desire is enough to trigger that response and a purchase isn’t even necessarily needed!

So keep that in mind the next time you’re looking for a mood boost… just looking, but not buying can be enough to make you feel better.

We don’t want to see anyone let this get out of control and turn into a shopaholic where you just buy things recklessly only to feel good. That will definitely catch up to you later and make you feel far worse.

How We Were Raised

Believe it or not but how we grew up plays a very important role in how we see money as adults.

Your parents shape your life in so many ways, but when it comes to finances, this is probably where you get most of your tendencies from.

Did your mom go shopping all the time and spend recklessly? Well, chances are that trait may trickle down to you.

Were you considered poor when you grew up? Studies show that as an adult you will act more impulsively later on in life, even with a good income.

So next time you’re wondering why you might impulse buy? Start looking at the way you grew up and you’ll probably start to uncover a lot of truths.

Your past often plays a large part in your future, as uncomfortable as it may be. However, if that’s you, look at it as having room for improvement!

How To Stop Impulse Buys

OK, so now we know a little bit more about what impulse buys are and what factors go into making us impulse buyers but what can we actually do to stop or avoid impulse buys altogether?

Have a Plan

This sounds too simple right? I know! But it works.

If you go to the grocery store with a list, you’re much less likely to start wandering the aisles adding junk food and extras.

Here’s a sample grocery list:

- Milk

- Eggs

- Beef

- Cheese

- Ketchup

- Bananas

- Water

- Shampoo

Now, when you have a list like that the chances of you now deviating and adding that can of Pringles chips shrinks a lot!

Honestly, that’s one reason I love shopping with Instacart. You simple make your list and you know your shopper is going to follow that exactly. The added fees usually offset the “extra” purchases in that way. =)

The same goes for a gift shopping list.

If you know your nephew Timmy wants an Optimus Prime action figure, then search out an Optimus Prime action figure and only buy that.

Don’t worry about “Also Recommended” or “You may also like” – don’t even look at those sections.

Just buy what you set out to and call it a day.

Make a Budget And Actually Follow It

Budgeting is one of the most important things you can do to get your finances on track and stop impulse buying.

A budget will hold you accountable for your purchases and can act as a yes/no decision maker. When you take the decision out of your hands it makes it so much easier.

For this to work, you have to have conviction that your budget is your guide.

We’ve all heard that little voice in our heads telling us it’s ok to buy that shiny object. You’re not alone.

Always ask yourself…”is this in the budget?” If the answer is no, then move on.

Going against your budget and buying things you shouldn’t will add up to a lot of wasted spending!

Sleep On It

As we talked about before, you get a dopamine hit just from shopping. So simply looking for an item and adding it to your cart should be enough to release those hormones that boost your mood.

Now, don’t buy it! Leave it in your cart and come back tomorrow.

Do you really want the item as much now?

If you’re still just as excited for it, then maybe it’s worth considering.

However, more times than not you probably won’t even care.

I can’t tell you how many times I’ve added something to my cart, only to look the next day and wonder, “why did I even add that?”

If I had made the purchase the night before I would have definitely had buyer’s remorse soon after!

Trust me, this is a powerful technique that can save you from lots of unwanted spending.

Don’t Save Your Credit Card Info

The “save this card for later” was one of the most convenient things ever created while simultaneously becoming one of the most dangerous ways to overspend on things.

Whether it be on Amazon or maybe just your web browser itself, they’re all too eager to help you get your credit card information entered and get you to that checkout page.

Don’t get me wrong, it’s great! I used to dread having to get up and go find my wallet, pull out my credit card and squint as I type all those digits.

But there is no easier way to get yourself in trouble than having easy access to just mindlessly checking out without even having to stop and think about how that order is going to get paid for.

So, if you also fall into this category of all-too-easy-to-checkout-itis then I have a solution for you.

Remove your credit card data from any sites that hold it, or your web browser.

Yeah, I know, it’s going to be a pain in the butt to give it up, but if you care about truly removing that temptation of impulse buys, this step will go a long way.

And maybe you’re just a chronic overspender for the holidays…re-save the cards after the New Year as long as you can remain in control!

When Shopping For Gifts

I’ve found that the best way to stay on budget when shopping for gifts is to assign a quantity and price limit per person.

For example, let’s say I’m buying gifts for my nephew. I may limit that to one gift up to $25. That could be one toy…or maybe just a gift card. (Kids love gift cards nowadays!)

Maybe for my own kid I’d set a limit of 5 gifts worth $200. That means one gift could be $100 and 4 gifts could be $25 each, or some sort of combination as long as I don’t go over $200 total.

It’s easy to give into impulse buying when shopping for gifts because we all want to make sure our gift recipient gets what they want and you may even think they’ll judge you based on the amount you spent on them. I think that’s an excuse largely made up in our own minds, after all, it should be the thought that counts!

Impulse Buying Examples

Let’s say you were running to Target to get a toy for your niece’s Christmas Present. While you’re there you can’t help but notice the electronics department right across the way with it’s bright lights and TVs all playing the same thing.

So bright, so magnificent.

You mosey over just to check things out. You don’t NEED a new TV or anything but you’re just curious.

Oh WOW, you see that big 75″ on sale for 50% off and only $399?!? Well, your TV is starting to get old and you paid way more than that for your much smaller TV so this HAS to be a great deal.

And, now my friend, you’re about to make an impulse buy. It can really happen that fast.

Here’s another example that I’m guilty of. Like I’m so guilty of this I literally had to stop myself from buying this while looking for an example to show for this section.

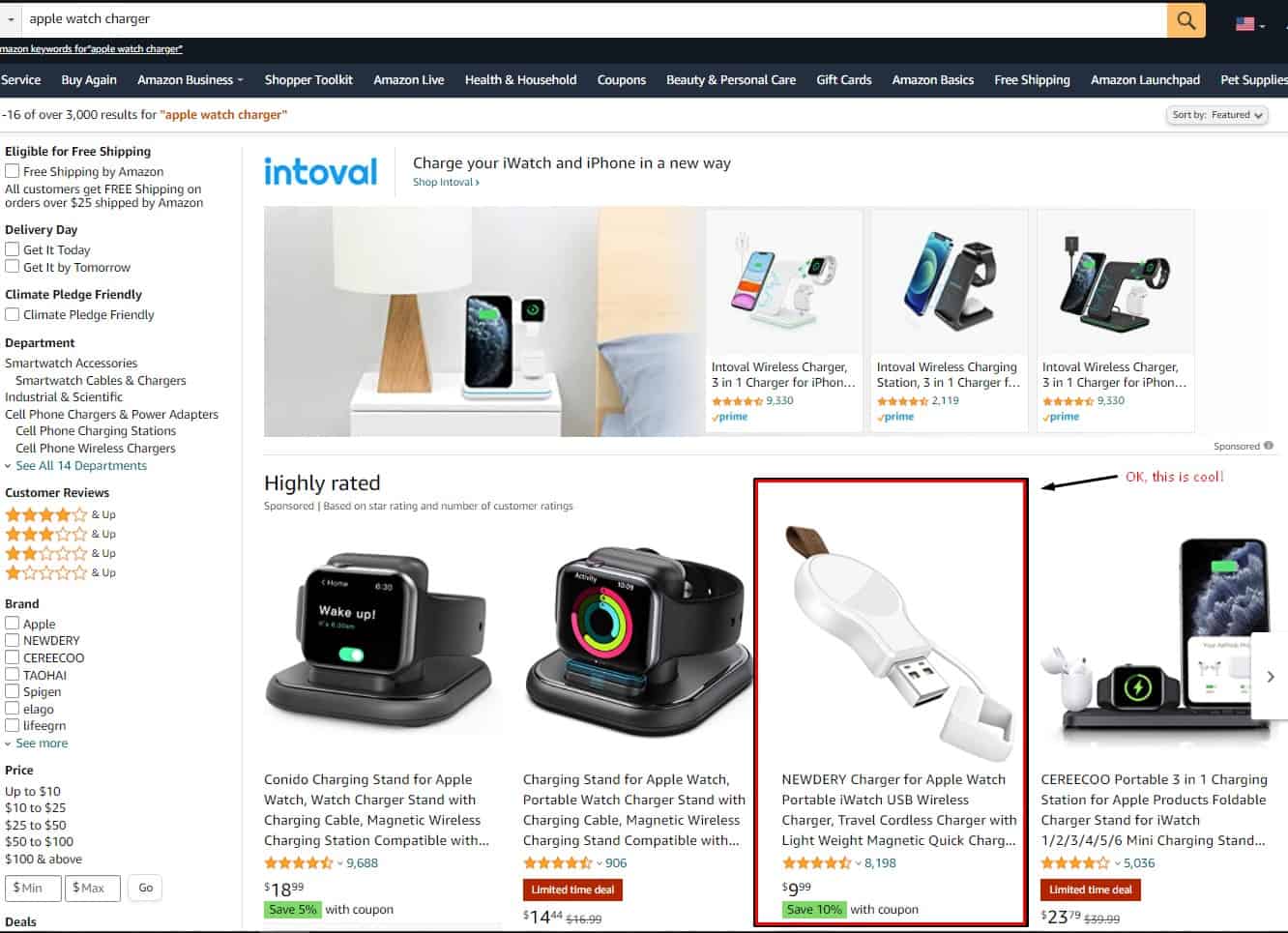

I got an Apple Watch not too long ago so I knew there’d be 9 million accessories available on Amazon.

As you can see I simply typed in “apple watch charger” at the top to see what results came up.

I saw the portable charger that I highlighted and it made me think that I have an upcoming trip and I’ll need to charge my watch…but I don’t want to take my current charging stand or disassemble it to take the charging puck.

So this would be perfect!

Well, this would also be an impulse buy. I added it to my cart, paused to give it some thought and realized I had a spare charging puck in my media room I could just stick in my bag. Buying this would just be wasted money on a gadget I’ll hardly ever use.

I know the $9 doesn’t seem like a big deal, but if you cave into these purchases often enough, believe me, they add up!

Did you know that the average American spends nearly $183 a month on impulse buys?

What Are The Most Common Impulse Buys?

Candy Bars and Soft Drinks are two of the most common impulse buys. They’re usually placed at every checkout aisle for easy access. You may have burned some energy shopping and want to refuel. And they’re often cheap enough that you don’t think twice about grabbing one or two for the road.

Clothing and Shoes are often considered impulse buys. Let’s be honest here, chances are you have all the clothes and shoes you need. But sometimes you see something you just have to have and splurge on yourself a bit. Nothing wrong with that at all, but most of the time it’s still an impulse buy when it happens.

Technology related items are also a very common impulse buy. As we try to fend off boredom we often turn to some sort of gadget to pass the time. It could be a kindle, or a new set of Air Pods.

We’re bombarded with ads all the time just hoping to strike a nerve with us so we wind up hitting that Checkout button.

Who’s More Likely To Impulse Buy? Men or Women?

Without trying to make this a battle of the sexes, I’ll give you the politically correct answer: it depends.

Why is that?

Well, according to this poll, men were the most likely to make an impulsive purchase over $50 (17% vs 16% for purchases $50-$100 and 23% vs 16% for purchases over $100)

I know what you’re thinking, “So the answer is men. Why didn’t you just say that?”

Because, in that same poll, women responded they were more likely to make impulse buying decisions on items less than $10 (10% vs 9%), $10-$25 items (17% vs 14%), and $25-$50 items (19% vs 16%)

So, again, it depends.

You could also say that perhaps women are more likely to buy impulsively when an item is under $50, while men will splurge more easily on items over $50.

Final Thoughts

Hopefully after reading this you are a little bit more aware of what impulse buys are and how they can sneak up on you while you’re doing your shopping.

Pretty much everyone gives in at some point and honestly, it can be a lot of fun in moderation!

You certainly don’t want to let it get out of control though. If you feel this way, read through the article again and take action on the points in this post.

Biggest takeaways:

- Have a plan for your shopping.

- Make a budget and stick to it (especially on Black Friday!).

- Sleep on it (give it some time before you buy.)

- Remove temptation by deleting credit card info.

If you can work on any and all of those 4 items you’ll be much more in control of your spending habits.

![Free 50/30/20 Calculator And How To Use It [2022 Guide]](https://spendster.org/wp-content/uploads/2022/10/Free-503020-Calculator-And-How-To-Use-It.jpg)